Este artículo también está disponible en español.

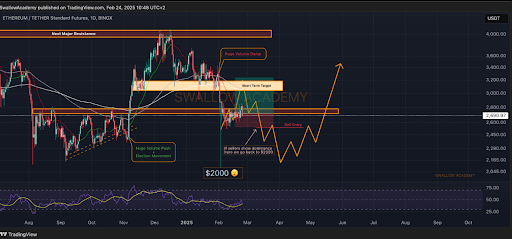

Ethereum’s price trajectory has taken a sharp downturn, with technical analysis showing a possible crash to $2,000. Crypto analyst SwallowAcademy pointed out on the TradingView platform that some bearish signals are forming in smaller timeframes, especially as buyers have failed to maintain a key support zone at $2,700. Notably, the broader market downturn over the past 24 hours has only strengthened the case for further declines for Ethereum.

Ethereum Plunges Over 12% In 24 Hours As Market Suffers Steep Losses

The crypto market has taken a heavy hit, with Bitcoin falling below major support at $90,000 and shedding 6.9% over the past 24 hours. An already struggling Ethereum has fared even worse, with its price plunging 12.6% in the same timeframe. Particularly, Ethereum broke below support levels at $2,600, $2,500, and $2,400 in quick succession.

Related Reading

This steep decline has aligned with SwallowAcademy’s warning about Ethereum’s weakness on smaller timeframes, further lending weight to the possibility of a more profound drop to $2,000. SwallowAcademy had initially emphasized that Ethereum remained in a solid buying zone due to the presence of EMAs at the $2,700 support. However, with price action shifting, the analyst acknowledges that bearish pressure on lower timeframes could open the door for further declines.

Interestingly, this Ethereum price crash in the past 24 hours came as a surprise, as bulls managed to hold above a key support level of $2,700 despite the fiasco of Bybit’s $1.5 billion hack that took place throughout the weekend.

Although the immediate fallout from the exchange’s hack appeared contained, the market now seems to be experiencing a delayed reaction, and fear is gradually setting in among investors. This growing uncertainty, combined with persistent outflows from crypto investment products, including Spot Bitcoin and Spot Ethereum funds, has added more downward pressure on Ethereum’s price.

As it stands, the current Ethereum daily candle is firmly in the hands of sellers, with no signs of easing pressure. This is a significant change from the previously strong buying sentiment.

Bearish Momentum Could Extend To $2,000

The weakening weekly candle has tipped the scales towards more declines than a bullish uptrend, though it is still early in the week to decide. cautions that it is still early in the week. Ethereum is already trading below the EMAs in the daily timeframe, so the crucial factor is whether it can hold above the EMAs in the weekly timeframe.

Related Reading

If the current selling momentum continues and the price breaks below $2,200, the next major downside target is $2,000 before any notable bounce can occur.

At the time of writing, Ethereum is trading at $2,395 and is at the risk of more declines over the next 24 hours. Despite the sharp drop, the RSI has yet to reach oversold conditions, which means that sellers may still have room to push prices lower before exhaustion sets in.

Featured image from Adobe Stock, chart from Tradingview.com